Lowering Corporate Tax Rates Isn’t The Solution

For years, Republican lawmakers have been calling for lower corporate tax rates. It is a common refrain that America has the highest corporate tax rate in the world. We do have one of the highest, but it isn’t the highest. However, with that high tax rate, you get some of the strongest protections in the world for intellectual property rights.

Recently, Americans have become quite alarmed at the spate of American companies buying foreign corporations and then doing something called tax inversion. They decide that their headquarters or corporation will be based in the country of the company they just bought to avoid the supposed high American taxes. It isn’t like most of these companies actually pay the full corporate tax rate, but they are just using the purchase as an excuse to pay even less in taxes while still taking advantage of all the perks of doing business in America as an American company.

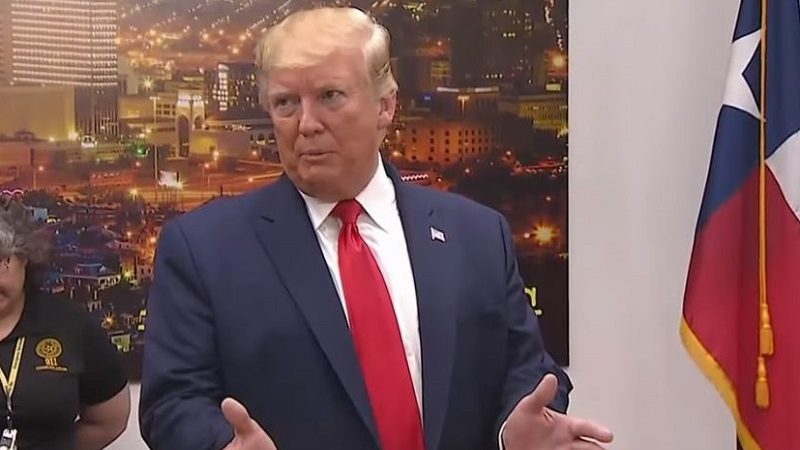

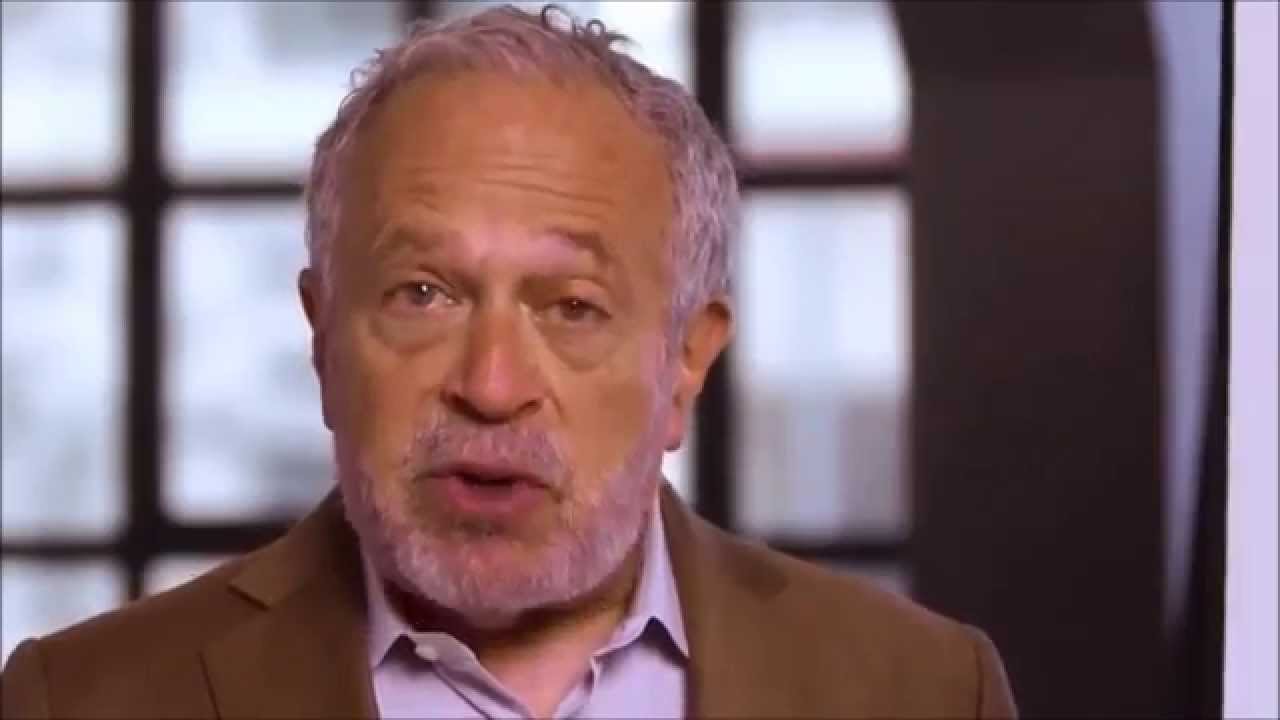

For this reason Presidential candidate Donald Trump, like all other Republicans who want to eradicate the corporate tax base of our economy, has said we should lower the corporate rate to 15%. I am sure that a lot of people think this is a good solution to the problem, but it isn’t. I am not an economist, so I can’t explain in great detail why it isn’t, but Robert Reich can.

Today Mr. Reich put out a detailed argument why we shouldn’t be dropping our tax rate for corporations who think it is in their interest to play this sneaky tax inversion game. Please, go read his post, What to do About Disloyal Corporations. It isn’t long, and if you as concerned about how these corporations are stealing our tax money to pay their fat cat corporate CEO’s millions in compensation for making these sorts of underhanded deals, it is worth the few minutes of your time. Every American in this country should read this short post and forward it on to their Congress-people to peruse as well.

That may seem a bit drastic, but it shouldn’t be. The corporate contribution to our tax base has been eroding for years despite the supposedly high rate, and something has to be done about it. In 1950, the corporate percentage of the tax burden was 40%, but in 2014 that percentage had dropped to 11%. That is appalling. It is estimated that American companies have 2.1 trillion dollars in untaxed profits stashed overseas. How much more could our federal government pay for instead of cut from safety net programs or the military if American companies did the responsible thing and paid their taxes like the rest of us?

I can’t explain Mr. Reich’s piece as well as he can, but in short he says we should take away the benefits of being an American company for corporations that try to pull the wool over our eyes like this. Like I said before there are a lot of perks to being an American company, and he gives seven of them in his post. If we really want to help our country prosper and move forward without making the majority of our populace suffer needlessly because of continuous budget cuts, we should make our representatives read this paper and begin to enact these suggestions immediately.